An estimated Markov-switching DSGE modeling framework that allows for parameter shifts across regimes is employed to test the hypothesis of regime-dependent credibility of Hong Kong’s linked exchange rate system. The baseline model distinguishes two regimes with respect to the time-series properties of the risk premium. Regime-dependent impulse responses to macroeconomic shocks reveal substantial differences in spreads. To test the sensitivity of the results, a number of robustness checks are performed. The findings contribute to efforts at modeling exchange rate regime credibility as a nonlinear process with two distinct regimes.

Aug 16, 2019

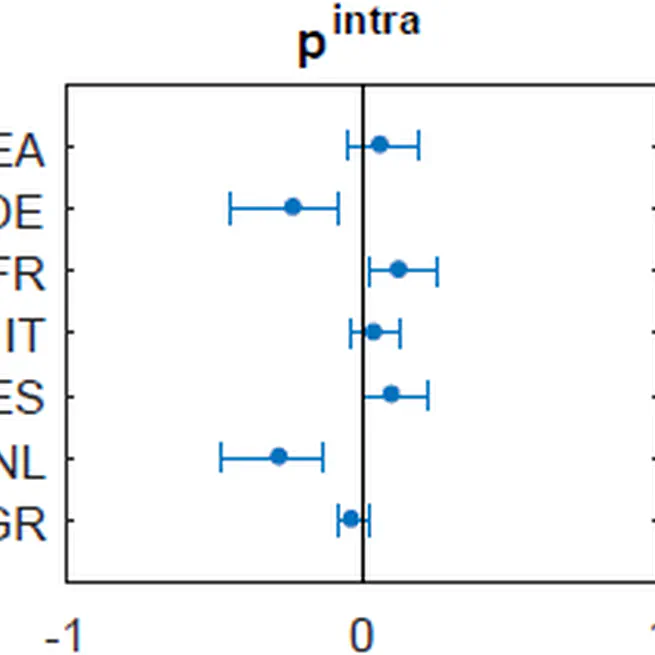

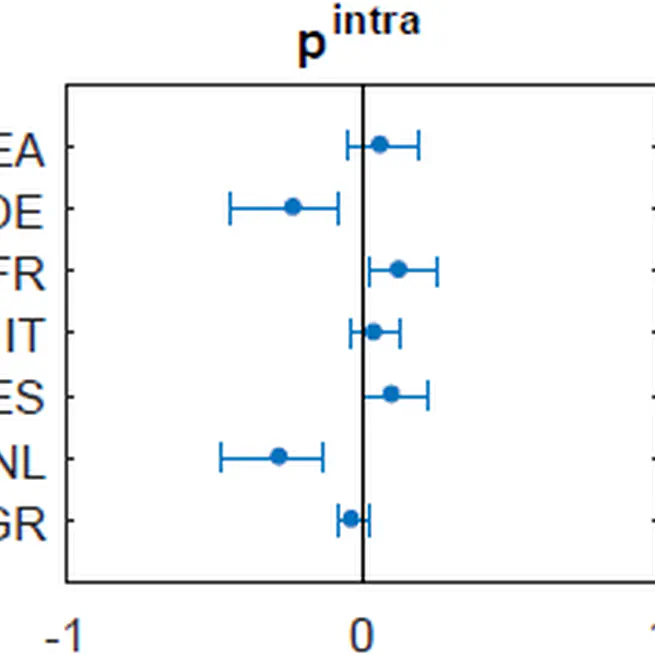

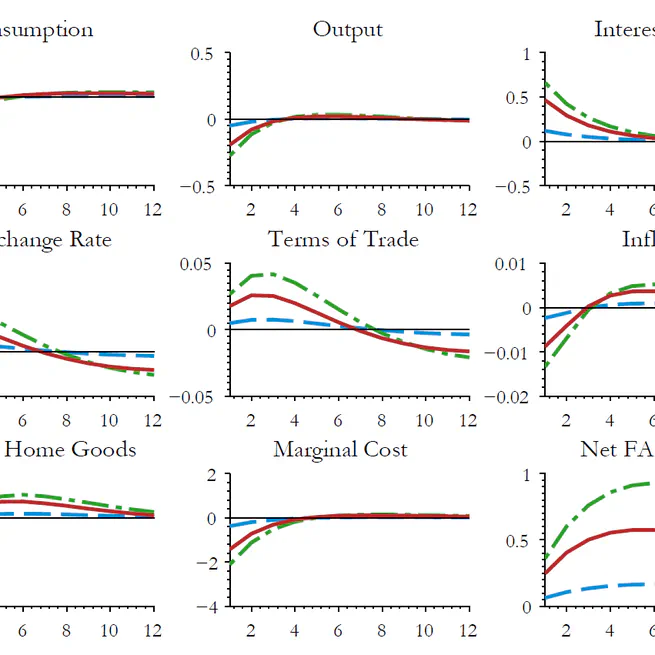

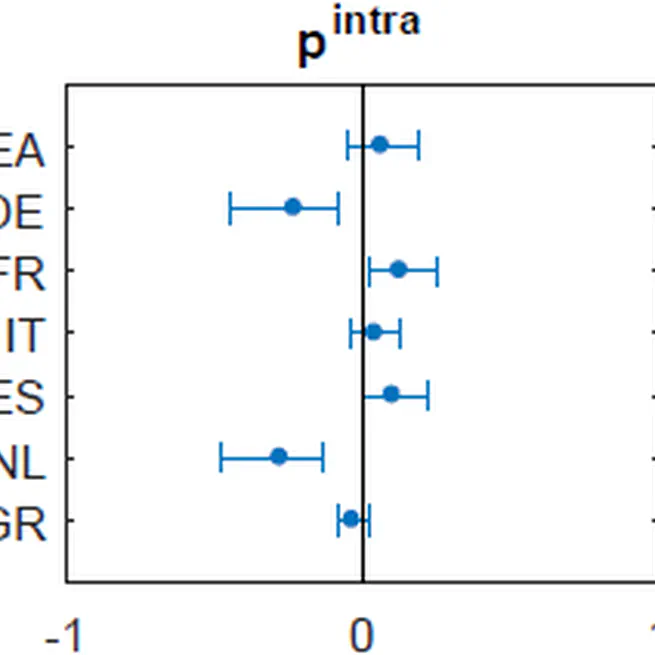

This paper analyses the effects of exchange rate uncertainty on the pricing behaviour of import firms in the euro area. Uncertainty is measured via the volatility of the structural shocks to the exchange rate in a non-linear VAR framework and is an important determinant of import prices. An increase in exchange rate uncertainty is associated with a fall in prices on average, which suggests that the exchange rate risk is borne by the importers. The analysis utilizes a dataset on industrial import prices, disaggregated by origin of imports. Controlling for intra- and extra-euro area trade is important.

Aug 16, 2019

May 2, 2018

Jul 6, 2016

Apr 7, 2015